Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Chaos Labs

Chaos Labs kirjasi uudelleen

AI is the best demoware ever invented.

You can hack something in a weekend, post a screen share, and go viral.

But turning that into a product people trust is brutal. The first time users lose trust, they’re gone.

The gap between demo and production is massive. For all the AI investment so far, there are few breakout apps beyond frontier labs and coding tools.

Closing that gap takes two capabilities:

1. Building a killer app - this is hard enough.

2. Bending an LLM to your will - this is breaking new ground, as we're all learning how to master them.

It’s hard.

But if you can do both, the opportunity is enormous.

2,34K

Chaos Labs kirjasi uudelleen

Control > Borrowed Security

Stripe and Circle launching L1s is just the start.

For years, the assumption was that enterprises would choose Ethereum, Solana, or another public L1 for their security. The fully decentralized future was the utopia we hoped for.

In reality, when I talk to large banks and fintechs, this is not what drives their decisions.

They are already regulated and audited. If they own the network, they see that as a stronger security guarantee. They choose the validators, control the upgrade process, and know exactly who is operating the infrastructure.

If something goes wrong, there is direct recourse. Enterprises are liable to their customers, and the business will take the hit if they act in bad faith.

And if you are moving trillions in stablecoin volume, no public network can offer meaningful economic security anyways.

If decentralization and economic security are not priorities, what's left?

Valid reasons to launch on a public L1 is distribution and DeFi interoperability. If you need that audience and those integrations, it can make sense. But for fintechs that simply want to move stablecoins, FX, or other RWAs faster and cheaper, and can bridge to other chains when necessary, owning the L1 eliminates value leakage and gives full control.

Oracles and interop messaging protocols will be critical in breaking the data silos between private enterprise chains, public networks, and the broader web. Oracles and bridging protocols will grow in their sophistication over the next years to meet the requirements of neobanks, fintechs, etc.

Decentralization will be a spectrum, will be interesting to see the distribution over time.

5,57K

Announcements from @stripe and @circle’s (@arc) confirm our thesis: enterprise adoption will drive the next wave of stablecoin growth.

We built the Chaos AI Stablecoin Hub to compare and analyze stablecoins and synthetic dollar assets.

Join the waitlist:

Omer Goldberg30.6.2025

Excited to share the first @chaos_labs AI Hub, the Stablecoin Hub.

Hubs are domain-specific mini apps, surfacing agent-powered signals.

Compare @USDC, @USDT0_to, @withAUSD, @ethena_labs, and more.

Launching to (super) early beta users.

What other Hubs do you want to see?

6,71K

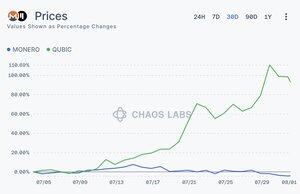

1/ @_Qubic_ briefly seized 52.72% of @Monero's hashrate, crossing the threshold for network control

Hashrate hit 3.01 GH/s as miners chased $3.13/day vs $0.64 on Monero. $QUBIC sales into stables drove $XMR down 28% in 30 days while $QUBIC rose 57%.

Chaos Labs1.8. klo 21.38

1/ @Monero community fights back as @_Qubic_ attempts hashrate dominance

Qubic's @c___f___b says he plans to control 51% of Monero's hashrate by August 2025. The project briefly reached 40% by paying miners to sell $XMR and fund $QUBIC burns.

$XMR down 5%; $QUBIC up 70%.

37,99K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin