Chủ đề thịnh hành

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

- chi phí: một L1 với 20 validator tập trung

- "lợi ích": ít MEV hơn, chuyển tiền bảo mật, hóa đơn nhúng trong giao dịch, hoàn tiền/tranh chấp trên chuỗi, stablecoin có lãi suất

đoán rằng động cơ chính chỉ đơn giản là kiểm soát nhiều hơn thay vì thiếu linh hoạt của Ethereum

12 thg 8, 2025

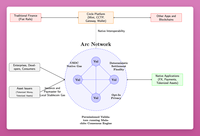

TL;DR - Circle's Arc

"Arc aims to be a top platform for tokenized, yield-bearing assets."

Centralization & TPS:

- Permissioned Validators: Regulated institutions (sic!) running a Tendermint-based PoA consensus (Malachite).

- ~ 3,000 TPS with a finality under 350 ms using 20 validators

- With four validators: 10,000 TPS, and finality is under 100 ms

In comparison, Solana pushes 4k-5k tps with 400-500 ms finality but SOL is more decentralized.

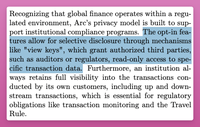

Privacy:

- Opt in Privacy: Confidential transfers (hidden amounts, visible addresses) with selective disclosure via "view key."

MEV:

- MEV Mitigation Roadmap: Encrypted mempools, batch processing, multi-proposer setup; preserves “constructive” MEV

Yield bearing stablecoin:

- USDC as default gas token but can pay fees using local stablecoins with "future embedded paymaster abstraction"

- It will launch supporting Circle’s USYC, an interest-bearing token backed by short-term U.S. Treasury securities. (This is cool).

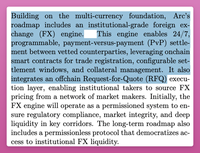

Bridging & trading

- Fast bridging/liquidity distribution via Circle’s CCTP and Gateway

- chain-abstracted balances (not bad)

- Arc will include a built-in currency trading system where approved institutions can settle FX trades atomically onchain, with prices sourced offchain through a request-for-quote process.

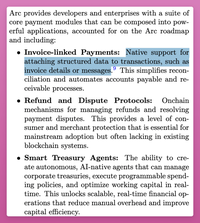

Payments:

- Arc will offer built-in tools for businesses to automate and secure payments, including invoices embedded in transactions, onchain refund/dispute handling, and AI agents to manage corporate treasuries.

816

Hàng đầu

Thứ hạng

Yêu thích