Tópicos populares

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

- custo: um L1 com 20 validadores centralizados

- "benefícios": menos MEV, transferências confidenciais, faturas incorporadas nas txs, reembolsos/disputas onchain, stablecoins que geram rendimento

a adivinhação do principal motivo foi simplesmente mais controle em vez da falta de flexibilidade do Ethereum

12/08/2025

TL;DR - Circle's Arc

"Arc aims to be a top platform for tokenized, yield-bearing assets."

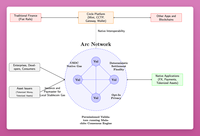

Centralization & TPS:

- Permissioned Validators: Regulated institutions (sic!) running a Tendermint-based PoA consensus (Malachite).

- ~ 3,000 TPS with a finality under 350 ms using 20 validators

- With four validators: 10,000 TPS, and finality is under 100 ms

In comparison, Solana pushes 4k-5k tps with 400-500 ms finality but SOL is more decentralized.

Privacy:

- Opt in Privacy: Confidential transfers (hidden amounts, visible addresses) with selective disclosure via "view key."

MEV:

- MEV Mitigation Roadmap: Encrypted mempools, batch processing, multi-proposer setup; preserves “constructive” MEV

Yield bearing stablecoin:

- USDC as default gas token but can pay fees using local stablecoins with "future embedded paymaster abstraction"

- It will launch supporting Circle’s USYC, an interest-bearing token backed by short-term U.S. Treasury securities. (This is cool).

Bridging & trading

- Fast bridging/liquidity distribution via Circle’s CCTP and Gateway

- chain-abstracted balances (not bad)

- Arc will include a built-in currency trading system where approved institutions can settle FX trades atomically onchain, with prices sourced offchain through a request-for-quote process.

Payments:

- Arc will offer built-in tools for businesses to automate and secure payments, including invoices embedded in transactions, onchain refund/dispute handling, and AI agents to manage corporate treasuries.

818

Top

Classificação

Favoritos