Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Eugene Bulltime

Head of Analytics & Partner @ContributionCap | Blockchain and Crypto researcher | DeFi Advisor | Fulltime in crypto since 2017 | My Research Hub ↓

Opportunity time for Lombard creators

After the last Kaito update, the amount of AI content has significantly decreased, many farmers have left.

This is good news for those who are ready to continue making quality content.

The competition has decreased - it used to be one of the highest at Lombard. This means that young new creators have got their chance. Use it.

Crisis is a time of opportunity.

Kaito update is a time of opportunity for creators of cool content.

I support all the guys who do quality work. Do not hesitate to tag me, I look at all the posts where I am mentioned. And if it is really cool content - I support it.

I hope to see many new guys in our bard community!

677

Opportunity time for Lombard creators

After the last Kaito update, the amount of AI content has significantly decreased, many farmers have left.

This is good news for those who are ready to continue making quality content.

The competition has decreased - it used to be one of the highest at Lombard. This means that young new creators have got their chance. Use it.

Crisis is a time of opportunity.

Kaito update is a time of opportunity for creators of cool content.

I support all the guys who do quality work. Do not hesitate to tag me, I look at all the posts where I am mentioned. And if it is really cool content - I support it.

I hope to see many new guys in our bard community!

456

Everyone thinks BOB is just a Bitcoin L2. They’re wrong.

When people hear @build_on_bob , they usually think of a Bitcoin L2. That’s only partly true - and here’s why.

BOB is built on the OP Stack, giving it a full EVM environment with ETH as gas. All transaction batches are posted to Ethereum blobs, which technically makes BOB an Ethereum L2.

Recently, the team introduced zk technology - called Kailua - to verify transaction batches. This reduced finality from 7 days to just a few hours.

So far, nothing surprising—most of this is public knowledge. The real question is: why is BOB considered a Bitcoin L2?

The Bridge That Started It

One of BOB’s core components is BOB Gateway - intent-based bridge connecting Bitcoin and BOB via relayers and liquidity providers. It lets users move BTC into BOB and immediately deploy it into DeFi strategies. This gives BOB arguably the best DeFi UX on the market today.

However, this gateway has trade-offs: centralization risks, security challenges, economic issues, and extra fees. It’s an interim solution, not the final vision.

The Next Evolution: Phases 2 & 3

In the next development phases, BOB will align deeply with the Bitcoin network through two key innovations:

1. BitVM Bridge – first trustless BTC bridge between Bitcoin and BOB, developed with the @fiamma_labs . This cutting-edge tech allows seamless BTC deposits and withdrawals without trusted intermediaries.

What is BitVM in details:

2. Bitcoin Security Service (BSN) from @babylonlabs_io - Gives BOB the same security level as Bitcoin by paying part of network fees for Babylon’s Shared Security Service. BOB’s state will be committed to Bitcoin via the Timestamp Protocol, making Bitcoin act as a DA layer.

What is BSN in details:

2 DA Layers, 1 Secure Network

Once live, BOB will have:

Ethereum DA – via blobs (standard for OP Stack)

Bitcoin DA – what @dom60808 calls a Fallback Layer

This architecture (BitVM + BSN) unlocks a powerful advantage: BOB can build native, trustless bridges to virtually any network - with Bitcoin-level security. Imagine moving $SOL or $SUI in and out of BOB natively, without wrapping or centralized custody.

Why This Matters

The BOB team’s vision is ambitious: to become a decentralized CEX replacement - a high-security, Bitcoin-backed DeFi hub.

In other words, BOB is not just “an L2.” It’s an EVM-compatible network, Bitcoin-based at its core, capable of bridging native assets across ecosystems.

It will combine CEX-like liquidity and UX with the transparency and security of DeFi.

======================================

If you liked the research, plz like/retweet and follow to @Eugene_Bulltime

And follow on strong visioners and analysts:

@0xBreadguy

@poopmandefi

@TheDeFISaint

@DoggfatherCrew

@0xSalazar

@DefiIgnas

@Defi_Warhol

@Moomsxxx

@hmalviya9

@Mars_DeFi

@rektdiomedes

@eli5_defi

@JayLovesPotato

@Steve_4P

@TheDeFinvestor

@0xCheeezzyyyy

@arndxt_xo

@alpha_pls

24,11K

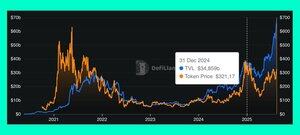

Morpho continues to grow quickly on Katana

Just look to fees chart

- Daily fees grew in 15x

- Cumulative fees are $63,000

- AFR (Annual fees rate ) is $1M

Crazy growth.

I think Morpho will exceed $1B of deposits on Katana to end of year.

@0xMarcB how much does Morpho share with Katana's CoL in %?

1,95K

Strategic partnership with Katana has led to strong growth for Moprho and Sushi:

- For Sushi: Katana is 2nd in TVL, just behind Ethereum

- For Morpho: Katana is 4th in TVL, catching up with Hyperliquid EVM

This is what a win-win partnership should look like:

where Katana gets reliable, time-tested DeFi services, and Sushi and Morpho get growth in user activity and business metrics.

27,97K

A few days ago, Lombard announced an important feature - now the number of LBTC increases natively - without additional claims.

This makes it easier to work with LBTC and Lombard.

But in order to implement this, Lombard had to significantly modify its architecture

Now, under the hood, they exchange your rewards on DEX and Cross-chain aggregators to simplify the UX.

Another technical update that shows the high level of the team.

3,44K

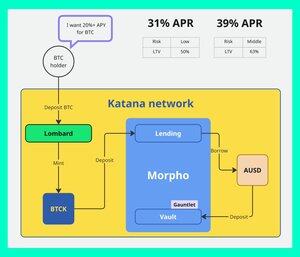

New option for 30%+ BTC yield:

1. Visit

2. Mint BTCK on Katana L2

3. Deposit BTCK to Morpho

4. Borrow AUSD at 50% LTV

5. Deposit AUSD to Gauntlet Vault

Yield!

Morpho offers a high-incentive program with Katana, providing ~52% APY for borrowing AUSD against BTCK.

Borrowing 50% of your collateral in AUSD, you get yield 26%.

Amplify this by depositing in Gauntlet Vault at 10% APR.

It's low-risk strategy, as liquidation occurs only if BTC falls 36%, which is unlikely.

Advanced DeFi strategists can boost BTC yield to 40%+ with managed risk.

NFA

4,2K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin