Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

defizard

Your everyday wizard. @pepe maximalist. Research and views are not financial advice.

defizard kirjasi uudelleen

➥ CT Smart Accounts You Should Follow Pt. 3

Smart Accounts to Follow is back with its third parts.

These accounts consistently dish out insights to help you master the whirlwind of Web3 with their alpha and educational content. (No need for me to go on; you should see for yourself.)

Without further ado, here's the list (NFA + DYOR):

➠ @rektonomist_

➠ @HarisEbrat

➠ @0xMughal

➠ @0xAndrewMoh

➠ @atoms_res

➠ @katexbt

➠ @bullish_bunt

➠ @Hercules_Defi

➠ @0x99Gohan

➠ @3liXBT

➠ @90s_DeFi

➠ @DOLAK1NG

➠ @belizardd

➠ @splinter0n

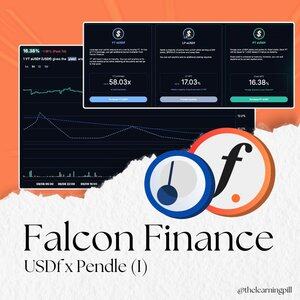

➠ @thelearningpill

➠ @green_but_red

5,49K

So, I just watched @phtevenstrong intereview with @newmichwill, and here's a summary.

🧵

Stephen | DeFi Dojo14.8. klo 22.29

I recently had the chance to interview the legend himself @newmichwill (founder of @CurveFinance) about his up-and-coming protocol: @yieldbasis.

Yieldbasis aims to generate a double-digit APR on BTC, which is a pretty radical claim.

Watch me pick his brain about it:

8,83K

defizard kirjasi uudelleen

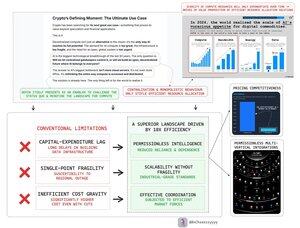

1/ Everyone in crypto shares a common hope: decentralisation.

For once, we’ve seen the power of distributed, open composability with DeFi.

Now, as we enter an AI-driven era the stakes & potential are far bigger than most realise.

"Crypto’s moment hasn’t come - yet." – @MTorygreen

Thesis🧵

5,45K

"How to not burn out in content creating?"

It's as simple as creating what you genuinely enjoy.

I mean, I absolutely enjoyed writing a thread on @GammaSwapLabs, which I didn't understand a few days ago and thought "why it's so complex, lmao..."

"Find a job you like and you will never work a day in your life." - Confucius

2,23K

Why crypto will replace the stock market.

Spoiler: it won't.

The real story is how blockchain tech will fundamentally re-architect global finance, merging the best of both worlds.

The global stock market is ~$133T. The entire crypto market? ~$3.8T.

Stocks represent ownership in a business with intrinsic value. Most crypto value is driven by speculation.

A direct replacement is a conceptual mismatch, right?

Up to 46% of Millennials and 55% of Gen Z investors own crypto. Why?

They're digital natives with a higher risk tolerance, FOMO, and distrust of traditional systems.

But huge hurdles remain.

"Huh?"

The #1 barrier is the "Regulatory Gauntlet."

Lack of clear rules handcuffs institutional adoption. Until there's a clear legal framework, crypto will remain on the institutional periphery.

In crypto, there is no FDIC-like insurance for your assets. Hacks are common, and transactions are irreversible. If your funds are stolen, they're likely gone forever.

Isn't this a massive risk for mainstream adoption?"So what's the real revolution?

Not new assets, but a new tech "wrapper" for existing ones: tokenization. E.g. @maplefinance, @SolvProtocol, @pendle_fi (i.e. Boros), @ClearpoolFin, etc.

I view this tweet as an alternative perspective on tokenization and believe that betting in protocols within this sector will pay off.

9,03K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin