Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Silo Labs

Silo Labs kirjasi uudelleen

Of all Pendle markets, $sUSDf has had arguably one of the most insane Implied Yield run-ups.

From its bottom at 10% Fixed APY, these suckers are now printing a market-leading 17% APY in fixed yield.

Now I could go into detail about WHY this is so but my good lad @PendleIntern has covered it quite well.

Markets up, fundamentals up, supply up - all-in-all, the types of metrics you look at to 'price in' the value of a future 🪂.

Of course, this leaves us with TWO routes to play the @FalconStable ecosystem:

🅰️ Maximize for points by aping YT

🅱️ Maximize for yields by aping PT

But why not a THIRD option...

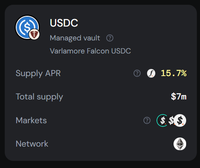

That's right: you can ALSO earn points on pure USDC exposure by lending in the Silo Falcon x Varlamore Vault.

With such insanely high demand driven by PT-sUSDf' borrow demand, this vault is PROBABLY the highest yielding venue that also cleans up 30x points.

That's similar yield to PT-sUSDf but you DONT MISS OUT ON POINTS.

DON'T TELL ANYONE BUT HERE'S THE LINK:

Silo Pendle Falcon

2,13K

Pendle? Silo.

Silo? Sonic.

246 Club13.8. klo 21.01

0/ re-aUSDC is NOW LIVE, exclusively available through the re-aUSDC(Dec18) market on @pendle_fi.

Link to Pool:

3,95K

Silo Labs kirjasi uudelleen

If you're stable'd up on @arbitrum, the Varlamore USDC Growth Vault is now yielding 18.2% APR.

This is 18.2% APR paid in pure stablecoins btw.

Demand for leverage is reaching new heights making lending markets a great way to realize profits while earning some very nice yields

7,13K

Silo Labs kirjasi uudelleen

My current source to farm @FalconStable Miles with a 30x multiplier is on @SiloFinance.

In @VarlamoreCap’s managed vault you can currently earn up to 28.6% APR, one of the highest returns available right now.

If you’re asking what managed vaults are, here’s a short definition:

A managed vault means someone else runs the strategy for you.

External teams decide where the funds go within approved markets.

You still control your deposit, but you trust the manager to handle things like adding markets or adjusting supply caps.

Are these APRs sustainable?

The current state of the market is playing in our favor.

I believe APR here will stay in the 15–30% range.

Using a 22% average feels like a reasonable estimate.

So for now, enjoy the current 28.6% APR and 30x Falcon Miles multiplier that should deliver juicy future rewards.

Super-Silo-Falcon-Varlamore.

4,94K

Silo Labs kirjasi uudelleen

Markets are pumping which means high funding rates and high PT APRs

ENA is pumping which means high sUSDe yield

The perfect storm for some leverage loops on @SiloFinance if you still have some idle stablecoins

Top Ethereum Loops

• @ethena_labs PT-sUSDe (Sep) - 66% APR

• @FalconStable PT-sUSDf (Sep) - 75% APR

• @ResolvLabs PT-RLP (Sep) - 78% APR

@SonicLabs Loops

• @GetYieldFi yUSD - 26% APR (incl points)

• @StreamDefi xUSD - 58% APR (self reported)

@avax Loops

• @avantprotocol savUSD - 58% APR (self reported)

• @StreamDefi xUSD - 45% APR (self reported)

Don't know how to loop stables?

✅ The manual Method:

1️⃣ Buy the stablecoin on a DEX or mint on project webpage

2️⃣ Deposit collateral to Silo vault

3️⃣ Max borrow against collateral

4️⃣ Repeat until wanted leverage, end the final loop without borrowing

I typically do 6 loops, this means you could end up doing 20 txs so make sure to include gas fees into the consideration if using Ethereum mainnet

✅ Automatic leverage:

For some pools Silo can automatically perform the looping for you.

Simply go to "Leverage tab" under Borrow, slide the leverage slider and deposit in a single tx

⚠️ Risks:

Note that this is not an endorsement of any of the stablecoins in the list. DYOR is advised

Leverage looping has liquidation risk, so make sure you understand the risks involved, and always leave a little wiggle room in case there's a depeg or if borrowing rates increase sharply

Also be aware of the borrowable liquidity if you plan to enter with size. If you max out the borrowable liquidity your borrow rates will go up by a lot

Some of the staked stablecoins might have a withdrawal period for going back to USDC

High yield never comes without risk

Note: I'm a Siloooo ambassadooor

22,74K

Silo Labs kirjasi uudelleen

We love the combination of risk isolation and high yield.

That's why I frequently check the @SiloFinance pool to see if there are any good opportunities available especially for newly launched auto-leverage strategy:

⟶ @SonicLabs

➤ xUSD <> scUSD — Up to 7.7x Lev and 77.3% APR + Silo Points

➤ yUSD <> USDC — Up to 5x Lev and 26.2% APR + @GetYieldFi Points + Silo Points

--

⟶ @ethereum

➤ RLP <> USDC — Up to 7.7x Lev and 50.2% APR + @ResolvLabs Points

➤ wETH <> ETH — Up to 12.5x Lev and 8.3% APR

--

⟶ @avax

➤ sAVAX <> AVAX — Up to 20x Lev and 39.8% APR

P.S. Some PTs are not included here as most of them will be expired by tomorrow.

20,18K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin