Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Odaily

💬 Zhu Su: 3AC has won the $1.53 billion lawsuit against FTX and is open to hearing SBF's new project ideas.

Zhu Su, the founder of Three Arrows Capital (3AC) @zhusu, stated that 3AC has won the $1.53 billion lawsuit against FTX @FTX_Official. He also mentioned that if SBF has new project ideas, he is willing to listen and expressed curiosity about SBF @SBF_FTX's views on Hyperliquid @HyperliquidX and the current Solana ecosystem, and inquired if there is a way to send a letter to SBF.

Zhu Su15.8. klo 00.01

Now that 3ac has won the lawsuit vs ftx for $1.53b, I feel like I would listen if sbf had some new project ideas. Also curious what he would think of hyperliquid. And the current solana ecosystem.

Is there a way to send him mail?

8,14K

💬 WLFI Advisor: USD1 has been minted on Solana @solana, but it currently lacks liquidity.

WLFI @worldlibertyfi Advisor Ogle stated that USD1 has been minted on the Solana network, but it currently does not have liquidity.

According to official information, $USD1 is currently circulating on the Ethereum mainnet, BSC, Tron, and Plume networks.

12,25K

📰Matrixport: The U.S. 🇺🇸 is entering a new round of liquidity release, and Bitcoin may rise alongside risk assets.

Matrixport @Matrixport_EN stated in its latest research report that the U.S. market is entering a new round of liquidity release, and structural funding support may drive Bitcoin and risk assets to continue rising, with the trend expected to last until 2026. Currently, the U.S. funding structure, credit environment, and policies are all favorable, and multiple factors may jointly push asset prices upward.

The report points out that U.S. money market funds have rapidly expanded since the fourth quarter of 2018, growing from $3 trillion to $7.4 trillion, with current annual interest income reaching $320 billion. Factors such as a rebound in credit issuance, an increase in commercial and industrial loans, and fiscal stimulus injecting liquidity may continue to support Bitcoin.

9,64K

📊 Bullish has entered the top five Bitcoin reserve public companies, while Tesla has dropped out of the top ten.

On the X platform, it was announced that the digital asset exchange Bullish ($BLSH) has entered the top five Bitcoin reserve public companies with a holding of 24,000 $BTC after its IPO. In contrast, Tesla ($TSLA) has fallen out of the top ten.

16,78K

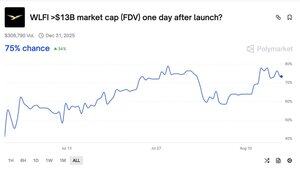

📈Polymarket predicts a 74% probability that "WLFI's first-day FDV will exceed $13 billion".

As the WLFI @worldlibertyfi token #TGE (expected around the end of August) approaches, Polymarket @Polymarket has raised its prediction for the probability of its first-day FDV exceeding $13 billion to 74%, an increase of 33% from before. It is estimated that the potential return rate for a public offering could be as high as 867%. (For details, see the article: "WLFI Approaches Trading, Understanding the Ecosystem's Current Status and Valuation Composition in One Article")

It is estimated that in terms of institutional costs, a total of 5 institutions (Tron DAO / Web 3 Port / Oddiyana Ventures / DWF Labs / Aqua 1 Fund) participated in the strategic round of financing, investing at least $210 million; among the known costs, DWF Labs @DWFLabs is 2 times the cost of Web 3 Port @Web3Port_Labs.

In terms of public offering costs, the two rounds of public fundraising raised a total of $550 million: the first round raised $300 million at a cost of $0.015, which is the lowest among the currently disclosed costs; the second round raised $250 million, with the cost increasing to $0.05, which is on par with Web 3 Port's book cost, far lower than DWF's cost. If the first-day FDV really reaches $13 billion, the return rate for the first public offering could be as high as 867%, and the second round could also be 260%. Additionally, there is an uncertain factor regarding the "TGE unlocking ratio," which will need to wait for the transferable proposal to pass for further clarification.

9,44K

🔵Coinbase: A comprehensive altcoin season may arrive in September, with BTC dominance dropping to a six-month low.

Coinbase @coinbase Institutional Research Director David Duong stated that the $BTC dominance has fallen from over 65% in May to about 59%. Coupled with the probability of a Federal Reserve rate cut in September rising to 92% and the total market cap of altcoins increasing by over 50% since early July, the market is entering the initial phase of capital rotation. If the macro environment remains loose, BTC dominance continues to decline, and new narratives emerge, September is expected to welcome a comprehensive altcoin season. Currently, while several altcoin season indices are below historical thresholds, they are showing positive signals, and institutional interest in Ethereum is heating up.

14,41K

📰 BitMEX: Bitcoin May Face Short-Term Pullback Risk

According to BitMEX @BitMEX analysis, Bitcoin hit a historic high today, reaching $124,000 before slightly retreating; Ethereum broke through the $4,700 mark, just a step away from its all-time high.

Although in the long term, expectations of interest rate cuts and institutional accumulation provide strong support for Bitcoin, there is short-term pullback pressure. First, according to statistics, Bitcoin's hash rate has rapidly declined since August 7, dropping from a peak of 965 EH/s to 892 EH/s on August 13. Since Bitcoin's hash rate is usually positively correlated with its price, the current trend suggests that short-term prices may face a pullback risk.

Secondly, from a technical analysis perspective (as shown in the figure below), Bitcoin's price trend is forming a potential bearish divergence with the MACD, and the current price may form a double top pattern with the July high, which could trigger a pullback. The recent potential support level is at the low point of August 2, which is also the high point from May, around $112,000. The blue upward trend line is a key support; if it breaks, further declines are expected.

9,72K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin