Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Erik Voorhees

Dear Venice users, native app (iOS and Android) launched today

Pls download app and give us a rating, super helpful in the early days.

Venice15.8. klo 00.52

Introducing the Venice App 🌅

Venice is the only AI app that keeps your conversations completely private

Get honest answers to any question, generate stunning images, and create without restrictions on your mobile device

113,33K

99% of financial advisors advised against the bottom two

Brian Armstrong14.8. klo 21.09

Asset gains over the last 10 years:

Gold: 201%

S&P 500: 207%

BTC: 49,000%

ETH: 350,000%

Happy financial awareness day.

54,91K

Venice is now in the app store

@AskVenice vs @ChatGPTapp

Venice15.8. klo 00.52

Introducing the Venice App 🌅

Venice is the only AI app that keeps your conversations completely private

Get honest answers to any question, generate stunning images, and create without restrictions on your mobile device

59,29K

Completely shocked to learn that Trump's Bitcoin Reserve Policy is roughly the same as Biden's

FinancialJuice14.8. klo 20.18

US Treasury Secretary Bessent on Crypto reserve: We are not going to be buying it, will use confiscated assets.

93,72K

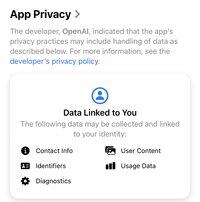

Since word is getting out, wanted to start clarifying what this DIEM thing is all about...

- The Venice token $VVV has always granted stakers free inference on the Venice API (private/uncensored generative AI, text and image)

- The amount of free inference received was determined by the capacity supply divided pro rata among all stakers on any given day. This amount naturally fluctuates, which made it difficult for stakers to plan long-term.

- Separately, our number one request from VVV stakers was the ability to tokenize their compute access so the *credit itself* could be traded... this is understandable since the a VVV holder is not always an API user.

- To address both the fluctuation of compute issue, and the desire from stakers to be able to sell their compute access, Venice is *tokenizing the compute itself* into a token called "Diem"

- DIEM (latin for day or per day) will grant $1 per day of Venice API credit. If you have 10 of them, then you get precisely $10 of usage every day. This solves the planning issue.

- As a token (on @base), DIEM will allow AI compute to be directly tradeable. This solves the request by stakers to trade their access to those using it.

- DIEM will be minted exclusively from $VVV, which locks the VVV until the same amount of DIEM is burned again.

- The amount of VVV required to mint 1 DIEM is determined by a novel "mint curve." This sets a natural asymptote on DIEM supply (required since each DIEM is a liability of Venice). When more DIEM is minted, the rate to mint another one increases. When DIEM is burned, the rate to mint another one decreases.

- A natural equilibrium will thus emerge, based in any moment on the demand for free inference from Venice's API relative to the price of $VVV and the current mint rate.

- All else equal, higher demand for private and uncensored AI inference from Venice will lead to higher DIEM price, and thus higher VVV price (because each VVV can now mint a more valuable asset)

- As an asset that grants access to $1/day of a resource (AI inference), DIEM can be valued with various Perpetuity Value formulas (what's an asset worth if it gives me $1 every day?)

- We believe this is a novel token design, in which two connected tokens exist, one of which has an unbounded trading range (VVV has no obvious min or max reasonable price), and the other of which has a clearly bounded trading range (DIEM can be properly valued with Perpetuity formulas). For the crypto econ nerds, it may be fun to study how this works and see what interesting relationships emerge.

- We'll convey more details via @AskVenice soon, and we expect the upgrade to happen this month. The upgrade will also reduce the $VVV emission rate (inflation) by roughly 1/3.

Chaz Schmidt💚22.7.2025

Can you do the math?

@AskVenice is tokenizing their AI API compute units now called Diem (formerly VCU)

The $VVV inflation is being lowered and it must be staked to generate Diem token.

123,45K

Erik Voorhees kirjasi uudelleen

One of the most valuable tools in my AI stack: the @AskVenice API.

It saves me serious money on daily automation and data processing by routing tasks to open source models instead of expensive corporate LLMs.

What's remarkable? After 10 years in the space, this is the first web3 project where the product is so useful that I completely forget there's a cryptocurrency involved.

This is exactly how web3 technology should work.

20,46K

Dear Solana community, now would be a good time to demonstrate fidelity to the principles of this industry

hww.eth | Hsiao-Wei Wang8.8. klo 03.34

The @ethereumfndn will be matching up to another $500K in donations to the legal defense of Roman Storm.

Privacy is normal, and writing code is not a crime.

The community can contribute to @rstormsf's legal defense here:

116,42K

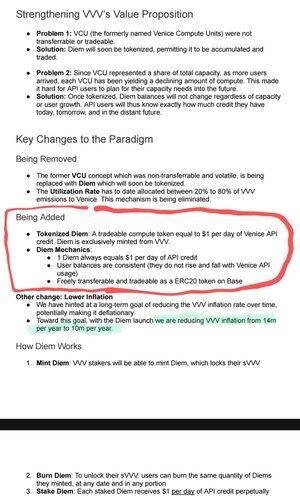

Either Elon stole this wealth, in which case Bernie should be advocating some kind of criminal case against him, or Elon produced and traded for this wealth, in which case he should rightly be viewed as a hero of civilization for such achievement, and an inspiration to others to achieve the same.

Crucially, Bernie's wealth comes to him after being taken by force from others, while Elon's does not.

And if you care about the plight of the poor, which all good people should, consider studying the structure of the financial system in which they operate. Consider, as Bernie shows, that from the 1970's something seems to have happened, structurally, that has lead to increasing wealth disparity.

This disparity has little to do with Elon's momentous achievements, and much to do with money being perverted into a fiat institution when it was severed from gold in 1971.

Civilization is sick because money itself—that blood which courses through its productive veins—was perverted.

And it was perverted by people very much like Bernie, who, being unable to produce themselves, advocate for the wholesale theft of what others produce. That overt theft is somewhat distasteful, many insidious methods have been devised... most notably, the debasement of currency, which not one citizen in a hundred even diagnoses as the problem.

Sen. Bernie Sanders6.8. klo 05.40

The top 1% now owns more than $54 trillion in wealth.

That’s 468 times more than the bottom 50%.

One man — Elon Musk — owns more than the bottom half COMBINED.

This is what I mean when I talk about oligarchy.

294,36K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin